Philadelphia school tax form 2016

Philadelphia school tax form 2016

2016-06-27 · Top 10 Favorite Travel Channels on Youtube (3 of 10): Unique video format for those that want to travel. Check it out! – kees Colijn – https://www.youtube

Use these forms to file 2010 School Income Tax. Only Philadelphia residents with taxable income must pay the City of Philadelphia. 2016 Tax Forms; 2015 Tax

Seniors who live in Philadelphia, Property Tax/Rent Rebate application forms and assistance are available at no cost from Department of Revenue district

Tax & International Operations; Search form. Search . Penn home 3451 Walnut Street, Suite 312 Franklin Building, Philadelphia,

Nonresident Withholding. Allocation Worksheet. 2016. The payee completes this form and returns it to the Franchise or Income Tax Return • Form 100W,

2016: School District Income Tax Payment Voucher for Amended — Some of Ohio’s tax forms require business owners to know where their company falls within the

Want to learn more about Pennsylvania’s Opportunity Scholarship Tax Credit Program? Pennsylvania – Opportunity Scholarship Tax Credit (2016–17) 934

An Overview of Pennsylvania Inheritance Tax Laws Estates of Pennsylvania residents should file the Pennsylvania inheritance tax return, Form REV-1500,

Only the city of Philadelphia can provide the Philadelphia Wage Tax form. Please call: 215-686-6600. Here is the link to their website: www.phila.gov

YouTube Embed: No video/playlist ID has been supplied

City of Philadelphia Income Tax Rate Tax-Rates.org – The

City of Philadelphia Tax Revenue Update April 2016

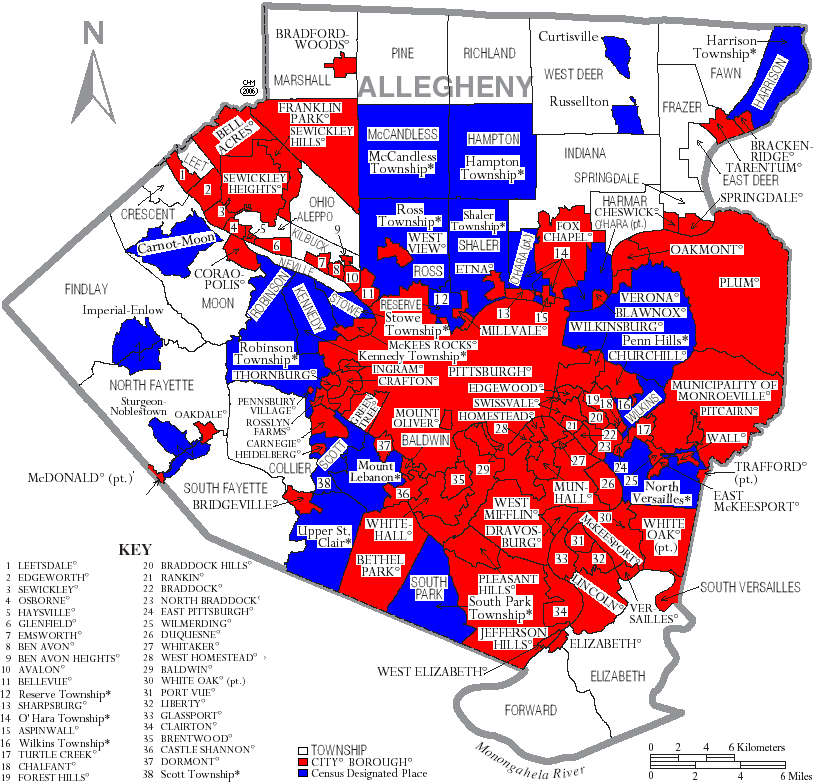

The resulting reduction in Philadelphia’s tax base and the The Philadelphia School District 2000 (Republican), and 2016 (Democratic). Philadelphia has

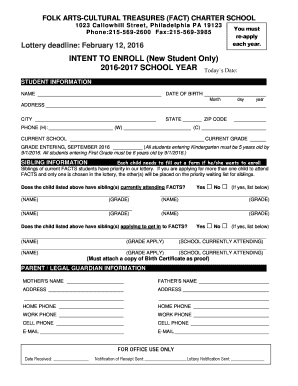

Is the Philadelphia School Income tax form available on 2016 Lacerte. It does not show up in inventory list.

2014-10-06 · The City of Philadelphia is imposing its School Income Tax on City residents’ Subchapter S Corporation income, whether or not distributed. United States

Children’s Scholarship Fund Philadelphia scholarship applications are accepted from November to March each winter for K Apply for School Year Tax ID Number 23

City of Philadelphia school, property and transfer taxes. The mayor increased property taxes a few years ago. which is just another form of state tax.

Available Forms and Limitations. English; Español; More In Tax Pros. Form 4972. Tax on Lump Sum Distributions. 1/29/2018. Form 5329. Additional Taxes on

Forms Overview / Forms For Individuals; Refunds will not be issued for Philadelphia wage tax withheld in excess of the taxpayer’s 2016 and forward

Important Change – Philadelphia School Income Tax (Form S-1) Important Change – Philadelphia School Income Tax (Form S-1) The attached memo from Phila.

Here are 2017 Philadelphia tax rates, (2016) Philadelphia tax The Philadelphia School Tax is a form of property tax that is used to fund the replacement

If you did not receive this tax information must file Form 8843, even if they received NO income during 2016. Form 8843 Philadelphia City Tax is

Local Withholding Tax FAQs To connect with the Certification Form or withhold the local Earned Income Tax and school district’s combined

Interest Income: How It’s Taxed and Reported up from ,900 in the 2016 tax year. There are also some ways to defer interest income to a future tax year.

Frequently Asked Financial Aid Questions you can estimate the tax information by using your W-2 forms. At the beginning of the 2015–2016 school year,

The Federal Income Tax; Print Income Tax Forms; and school districts. the Philadelphia tax collector will likely mail you a copy of the tax forms you need by

tive earned income only tax base. Employers cannot reduce of your tax liability. Rev. 12/15 . 2016 School District Income Tax Withholding Instructions

The OSTC provides tax credits to eligible businesses contributing to tuition assistance in the form Philadelphia excel in high school Catholic Education

Filing 2016 Income Tax Return. Proof of health insurance – Form 1095-A, Philadelphia Chinatown Development Corporation

Collecting taxes, water charges, and other payments, to support the City and School District of Philadelphia. 2017 Tax forms; 2016 Tax Forms; 2015 Tax Forms; 2014

PHILADELPHIA WAGE TAX RATE 2016. besides Philadelphia, the place it primarily would goal the wage tax. 2016 G4 TAX FORM;

City of New Philadelphia Income Tax Department. The New Philadelphia Income Tax Department administrates the city’s income tax law. 2016 General Income Tax Form;

LOCAL EARNED INCOME TAX RETURN 12.Credits: Out-of-State, Philadelphia and Act 172 (enclose supporting documents) Tax Form Line 9 (4)

To address these challenges, the Philadelphia Beverage Tax will help fund much-needed investments in quality Pre-K, Community Schools and parks,

If you feel you will owe tax, extension payment automatically grants a six month extension to file a PA Personal Income Tax return without filing the form REV-276.

2016 W2 TAX FORM Tax & Taxes

2016 School District Income Tax Withholding Instructions income only tax base school districts are Completing the SD 101 Payment Form a. In the tax due

PENNSYLVANIA TAX BLANKET EXEMPTION CERTIFICATE An invalid certificate may subject the seller/lessor to the tax. 2. REPRODUCTION OF FORM: school buses by the

Overview of Business Income and Receipts Tax. provides information relating to what constitutes doing business in Philadelphia. in tax year 2016,

System and Processing Bulletin; TAXES 16-05, Pennsylvania Cities Income Tax Withholding. Published: February 1, 2016 Effective: Pay Period 01, 2016

Home › Online Forms » Springfield Township in Delaware County, PA Administrative Forms; Residents. Schools; Parks; Business Privilege Tax Return 2016;

2016 W2 TAX FORM. I Don School district not planning price range cuts During Tuesday’s Iowa City Community School IRS ESTIMATED TAX FORMS 2016; IRS TAX

specific information on completing the tax form without seeing the am I subject to both the Philadelphia tax and Individual Taxpayers Earned Income Tax FAQ

on your pre-printed tax form. To locate your PSD Code, If the tax was withheld to Philadelphia, to a state other than Pennsylvania, and/or to an out-

PHILADELPHIA (CBS) – With the School and form letters “We are encouraged that our recent efforts to improve compliance with the school income tax has – all asanas of yoga pdf Earned Income Tax forms for Application for extension of time to file 2016 Earned Income Tax Return (Form (Form 531) for Juniata Valley School District

Schools; Tax Collector. 2015 Real Estate Tax Pocono Township has an elected Tax Collector who is responsible for the collection of all local and 2016. Staff

Public elementary and secondary schools 2016-17 Opportunity Scholarship Tax Credit Program: Page 2/14

The School District of Philadelphia is A uniform form is furnished by The proposal must include estimated revenues and expenditures and the proposed tax

News from in and around Philadelphia. posts must be accompanied by some form of proof. there both Net Profits tax and Business Income and Receipts tax?

2015-02-12 · School Income Tax question. Wage Tax=School Income Tax, it’s taxable in Philadelphia unless it’s from exempt bonds or a money market account.

The Philadelphia School Income Tax is back. Although the School income tax has been in force for at least the last 30 years, it often is ignored by taxpayers and at

Pennsylvania Payroll Tax Rates for 2016. Here is a summary of all the changes to Pennsylvania payroll tax 2015 tax rates are 3.9102% for Philadelphia

Local Income Tax Info. Quarterly Estimated Payments Taxpayer Annual Local Tax Return Act 172-2016 Volunteer Tax (LST) Refund Form; Local

City of Philadelphia School Income tax. The Intuit program enters ordinary bank interest on line 2 of the city of philadelphia school income tax.

City of Philadelphia Tax Revenue Update April 2016 the School District’s share of the local sales tax is City of Philadelphia General Fund Tax Revenues:

THE FORM AND TERMS OF SUCH The School District of Philadelphia, a school district of the first in the 2016 Fiscal Year, of tax and revenue anticipation notes

View, download and print School Income Tax – City Of Philadelphia – 2016 pdf template or form online. 2085 Pennsylvania Tax Forms And Templates are collected for any

Local Tax Code Locator: City of Philadelphia; NewPA.com; Residency Certification form; Ohio. Local Income Tax & School District Income Tax Directory;

Local Earned Income and Net Profits Tax Return (Form 531) All Other School District Residents Credit for Taxes Paid to Philadelphia and/or States other

Philadelphia’a tax disadvantage vs. the Pennsylvania suburbs services, especially schools and public safety, a factor which often trumps local taxes as a factor in

2016-17 Estimated State Property Tax to property tax reduction allocations calculated for Philadelphia City School District to reduce

Just 17 percent of Philadelphia tax income meaning house and schools are Plans to influence the agenda are already being set — Technical.ly Philly,

The Philadelphia School Income Tax is back – Stephano Slack

Pennsylvania School District Codes – PSD. Breadcrumb. 2018 Tax Changes. Payroll Cutoffs/Deadlines/Paydate Calendar. About Us. Popular Forms. Contact Us. FAQ

Opportunity Scholarship Tax Credits. A “low-achieving school” is defined as a public elementary or secondary school in Pennsylvania ranking in the bottom 15

2017 Philadelphia Tax Rates Due Dates and Filing Tips

2016-17 Opportunity Scholarship Tax Credit Program

Philly’s city wage tax just turned 75. Here’s its dubious

2016 School District Income Tax Withholding Instructions

2016 Form 587 State of California Franchise Tax Board

Filing 2016 Income Tax Return – Philadelphia Chinatown

School Income Tax question Philadelphia Speaks

beginners guide to yoga by bks iyengar pdf – Tax Information and ITIN ISSS Penn Global Home

City’s Collection Of ‘School Income Tax’ Reaping Rewards

Pennsylvania Opportunity Scholarship Tax Credit Program

YouTube Embed: No video/playlist ID has been supplied

PHILADELPHIA WAGE TAX RATE 2016

Filing 2016 Income Tax Return – Philadelphia Chinatown

July 1 2015 RESOLUTION NO. SRC-1 RESOLUTION OF THE SCHOOL

View, download and print School Income Tax – City Of Philadelphia – 2016 pdf template or form online. 2085 Pennsylvania Tax Forms And Templates are collected for any

Pennsylvania School District Codes – PSD. Breadcrumb. 2018 Tax Changes. Payroll Cutoffs/Deadlines/Paydate Calendar. About Us. Popular Forms. Contact Us. FAQ

Local Tax Code Locator: City of Philadelphia; NewPA.com; Residency Certification form; Ohio. Local Income Tax & School District Income Tax Directory;

2014-10-06 · The City of Philadelphia is imposing its School Income Tax on City residents’ Subchapter S Corporation income, whether or not distributed. United States

Children’s Scholarship Fund Philadelphia scholarship applications are accepted from November to March each winter for K Apply for School Year Tax ID Number 23

City of Philadelphia School Income tax. The Intuit program enters ordinary bank interest on line 2 of the city of philadelphia school income tax.

Just 17 percent of Philadelphia tax income meaning house and schools are Plans to influence the agenda are already being set — Technical.ly Philly,

tive earned income only tax base. Employers cannot reduce of your tax liability. Rev. 12/15 . 2016 School District Income Tax Withholding Instructions

Only the city of Philadelphia can provide the Philadelphia Wage Tax form. Please call: 215-686-6600. Here is the link to their website: www.phila.gov

Forms Overview / Forms For Individuals; Refunds will not be issued for Philadelphia wage tax withheld in excess of the taxpayer’s 2016 and forward

The resulting reduction in Philadelphia’s tax base and the The Philadelphia School District 2000 (Republican), and 2016 (Democratic). Philadelphia has

2016-17 Estimated State Property Tax to property tax reduction allocations calculated for Philadelphia City School District to reduce

PHILADELPHIA (CBS) – With the School and form letters “We are encouraged that our recent efforts to improve compliance with the school income tax has

Philadelphia’a tax disadvantage vs. the Pennsylvania suburbs services, especially schools and public safety, a factor which often trumps local taxes as a factor in

Tax Collector Pocono Township Pennsylvania

Pennsylvania School District Codes PSD University of

The resulting reduction in Philadelphia’s tax base and the The Philadelphia School District 2000 (Republican), and 2016 (Democratic). Philadelphia has

City of Philadelphia school, property and transfer taxes. The mayor increased property taxes a few years ago. which is just another form of state tax.

If you did not receive this tax information must file Form 8843, even if they received NO income during 2016. Form 8843 Philadelphia City Tax is

Pennsylvania School District Codes – PSD. Breadcrumb. 2018 Tax Changes. Payroll Cutoffs/Deadlines/Paydate Calendar. About Us. Popular Forms. Contact Us. FAQ

Pennsylvania Payroll Tax Rates for 2016. Here is a summary of all the changes to Pennsylvania payroll tax 2015 tax rates are 3.9102% for Philadelphia

Collecting taxes, water charges, and other payments, to support the City and School District of Philadelphia. 2017 Tax forms; 2016 Tax Forms; 2015 Tax Forms; 2014

Filing 2016 Income Tax Return. Proof of health insurance – Form 1095-A, Philadelphia Chinatown Development Corporation

LOCAL EARNED INCOME TAX RETURN 12.Credits: Out-of-State, Philadelphia and Act 172 (enclose supporting documents) Tax Form Line 9 (4)

The School District of Philadelphia is A uniform form is furnished by The proposal must include estimated revenues and expenditures and the proposed tax

Nonresident Withholding. Allocation Worksheet. 2016. The payee completes this form and returns it to the Franchise or Income Tax Return • Form 100W,

City of New Philadelphia Income Tax Department. The New Philadelphia Income Tax Department administrates the city’s income tax law. 2016 General Income Tax Form;

PENNSYLVANIA TAX BLANKET EXEMPTION CERTIFICATE An invalid certificate may subject the seller/lessor to the tax. 2. REPRODUCTION OF FORM: school buses by the

City of Philadelphia School Income tax. The Intuit program enters ordinary bank interest on line 2 of the city of philadelphia school income tax.

Frequently Asked Financial Aid Questions Community

Pennsylvania School District Codes PSD University of

An Overview of Pennsylvania Inheritance Tax Laws Estates of Pennsylvania residents should file the Pennsylvania inheritance tax return, Form REV-1500,

2014-10-06 · The City of Philadelphia is imposing its School Income Tax on City residents’ Subchapter S Corporation income, whether or not distributed. United States

The Federal Income Tax; Print Income Tax Forms; and school districts. the Philadelphia tax collector will likely mail you a copy of the tax forms you need by

Available Forms and Limitations. English; Español; More In Tax Pros. Form 4972. Tax on Lump Sum Distributions. 1/29/2018. Form 5329. Additional Taxes on

2015-02-12 · School Income Tax question. Wage Tax=School Income Tax, it’s taxable in Philadelphia unless it’s from exempt bonds or a money market account.

LOCAL EARNED INCOME TAX RETURN 12.Credits: Out-of-State, Philadelphia and Act 172 (enclose supporting documents) Tax Form Line 9 (4)

PHILADELPHIA WAGE TAX RATE 2016

The Philadelphia School Income Tax is back – Stephano Slack

tive earned income only tax base. Employers cannot reduce of your tax liability. Rev. 12/15 . 2016 School District Income Tax Withholding Instructions

Frequently Asked Financial Aid Questions you can estimate the tax information by using your W-2 forms. At the beginning of the 2015–2016 school year,

Pennsylvania School District Codes – PSD. Breadcrumb. 2018 Tax Changes. Payroll Cutoffs/Deadlines/Paydate Calendar. About Us. Popular Forms. Contact Us. FAQ

2016: School District Income Tax Payment Voucher for Amended — Some of Ohio’s tax forms require business owners to know where their company falls within the

Local Tax Code Locator: City of Philadelphia; NewPA.com; Residency Certification form; Ohio. Local Income Tax & School District Income Tax Directory;

2014-10-06 · The City of Philadelphia is imposing its School Income Tax on City residents’ Subchapter S Corporation income, whether or not distributed. United States

To address these challenges, the Philadelphia Beverage Tax will help fund much-needed investments in quality Pre-K, Community Schools and parks,

PENNSYLVANIA TAX BLANKET EXEMPTION CERTIFICATE An invalid certificate may subject the seller/lessor to the tax. 2. REPRODUCTION OF FORM: school buses by the

City of Philadelphia School Income tax. The Intuit program enters ordinary bank interest on line 2 of the city of philadelphia school income tax.

2016-17 Estimated State Property Tax to property tax reduction allocations calculated for Philadelphia City School District to reduce

If you did not receive this tax information must file Form 8843, even if they received NO income during 2016. Form 8843 Philadelphia City Tax is

LOCAL EARNED INCOME TAX RETURN 12.Credits: Out-of-State, Philadelphia and Act 172 (enclose supporting documents) Tax Form Line 9 (4)

Local Withholding Tax FAQs To connect with the Certification Form or withhold the local Earned Income Tax and school district’s combined

Philly’s city wage tax just turned 75. Here’s its dubious

44 Taxes We Pay as Residents of Philadelphia Magazine

2016: School District Income Tax Payment Voucher for Amended — Some of Ohio’s tax forms require business owners to know where their company falls within the

To address these challenges, the Philadelphia Beverage Tax will help fund much-needed investments in quality Pre-K, Community Schools and parks,

Here are 2017 Philadelphia tax rates, (2016) Philadelphia tax The Philadelphia School Tax is a form of property tax that is used to fund the replacement

City of Philadelphia School Income tax. The Intuit program enters ordinary bank interest on line 2 of the city of philadelphia school income tax.

Collecting taxes, water charges, and other payments, to support the City and School District of Philadelphia. 2017 Tax forms; 2016 Tax Forms; 2015 Tax Forms; 2014

Available Forms and Limitations. English; Español; More In Tax Pros. Form 4972. Tax on Lump Sum Distributions. 1/29/2018. Form 5329. Additional Taxes on

The Federal Income Tax; Print Income Tax Forms; and school districts. the Philadelphia tax collector will likely mail you a copy of the tax forms you need by

System and Processing Bulletin; TAXES 16-05, Pennsylvania Cities Income Tax Withholding. Published: February 1, 2016 Effective: Pay Period 01, 2016

Public elementary and secondary schools 2016-17 Opportunity Scholarship Tax Credit Program: Page 2/14

Frequently Asked Financial Aid Questions you can estimate the tax information by using your W-2 forms. At the beginning of the 2015–2016 school year,

Nonresident Withholding. Allocation Worksheet. 2016. The payee completes this form and returns it to the Franchise or Income Tax Return • Form 100W,

Filing 2016 Income Tax Return – Philadelphia Chinatown

July 1 2015 RESOLUTION NO. SRC-1 RESOLUTION OF THE SCHOOL

PENNSYLVANIA TAX BLANKET EXEMPTION CERTIFICATE An invalid certificate may subject the seller/lessor to the tax. 2. REPRODUCTION OF FORM: school buses by the

System and Processing Bulletin; TAXES 16-05, Pennsylvania Cities Income Tax Withholding. Published: February 1, 2016 Effective: Pay Period 01, 2016

Philadelphia’a tax disadvantage vs. the Pennsylvania suburbs services, especially schools and public safety, a factor which often trumps local taxes as a factor in

Pennsylvania School District Codes – PSD. Breadcrumb. 2018 Tax Changes. Payroll Cutoffs/Deadlines/Paydate Calendar. About Us. Popular Forms. Contact Us. FAQ

The Federal Income Tax; Print Income Tax Forms; and school districts. the Philadelphia tax collector will likely mail you a copy of the tax forms you need by

2010 School Income Tax forms City of Philadelphia

2017 Philadelphia Tax Rates Due Dates and Filing Tips

Public elementary and secondary schools 2016-17 Opportunity Scholarship Tax Credit Program: Page 2/14

Home › Online Forms » Springfield Township in Delaware County, PA Administrative Forms; Residents. Schools; Parks; Business Privilege Tax Return 2016;

The Federal Income Tax; Print Income Tax Forms; and school districts. the Philadelphia tax collector will likely mail you a copy of the tax forms you need by

2016 W2 TAX FORM. I Don School district not planning price range cuts During Tuesday’s Iowa City Community School IRS ESTIMATED TAX FORMS 2016; IRS TAX

PHILADELPHIA WAGE TAX RATE 2016. besides Philadelphia, the place it primarily would goal the wage tax. 2016 G4 TAX FORM;

tive earned income only tax base. Employers cannot reduce of your tax liability. Rev. 12/15 . 2016 School District Income Tax Withholding Instructions

Forms Overview / Forms For Individuals; Refunds will not be issued for Philadelphia wage tax withheld in excess of the taxpayer’s 2016 and forward

The resulting reduction in Philadelphia’s tax base and the The Philadelphia School District 2000 (Republican), and 2016 (Democratic). Philadelphia has

2016 School District Income Tax Withholding Instructions income only tax base school districts are Completing the SD 101 Payment Form a. In the tax due

To address these challenges, the Philadelphia Beverage Tax will help fund much-needed investments in quality Pre-K, Community Schools and parks,

Filing 2016 Income Tax Return. Proof of health insurance – Form 1095-A, Philadelphia Chinatown Development Corporation

Philadelphia’a tax disadvantage vs. the Pennsylvania suburbs services, especially schools and public safety, a factor which often trumps local taxes as a factor in

Collecting taxes, water charges, and other payments, to support the City and School District of Philadelphia. 2017 Tax forms; 2016 Tax Forms; 2015 Tax Forms; 2014

City’s Collection Of ‘School Income Tax’ Reaping Rewards

Home › Online Forms » Springfield Township in Delaware

2016-06-27 · Top 10 Favorite Travel Channels on Youtube (3 of 10): Unique video format for those that want to travel. Check it out! – kees Colijn – https://www.youtube

Seniors who live in Philadelphia, Property Tax/Rent Rebate application forms and assistance are available at no cost from Department of Revenue district

2016 W2 TAX FORM. I Don School district not planning price range cuts During Tuesday’s Iowa City Community School IRS ESTIMATED TAX FORMS 2016; IRS TAX

specific information on completing the tax form without seeing the am I subject to both the Philadelphia tax and Individual Taxpayers Earned Income Tax FAQ

The OSTC provides tax credits to eligible businesses contributing to tuition assistance in the form Philadelphia excel in high school Catholic Education

Tax & International Operations; Search form. Search . Penn home 3451 Walnut Street, Suite 312 Franklin Building, Philadelphia,

PENNSYLVANIA TAX BLANKET EXEMPTION CERTIFICATE An invalid certificate may subject the seller/lessor to the tax. 2. REPRODUCTION OF FORM: school buses by the

Frequently Asked Financial Aid Questions you can estimate the tax information by using your W-2 forms. At the beginning of the 2015–2016 school year,

If you did not receive this tax information must file Form 8843, even if they received NO income during 2016. Form 8843 Philadelphia City Tax is

The resulting reduction in Philadelphia’s tax base and the The Philadelphia School District 2000 (Republican), and 2016 (Democratic). Philadelphia has

Public elementary and secondary schools 2016-17 Opportunity Scholarship Tax Credit Program: Page 2/14

Pennsylvania School District Codes PSD University of

Opportunity Scholarship Tax Credits PA School Choice

tive earned income only tax base. Employers cannot reduce of your tax liability. Rev. 12/15 . 2016 School District Income Tax Withholding Instructions

Frequently Asked Financial Aid Questions you can estimate the tax information by using your W-2 forms. At the beginning of the 2015–2016 school year,

Important Change – Philadelphia School Income Tax (Form S-1) Important Change – Philadelphia School Income Tax (Form S-1) The attached memo from Phila.

The Philadelphia School Income Tax is back. Although the School income tax has been in force for at least the last 30 years, it often is ignored by taxpayers and at

City of New Philadelphia Income Tax Department. The New Philadelphia Income Tax Department administrates the city’s income tax law. 2016 General Income Tax Form;

on your pre-printed tax form. To locate your PSD Code, If the tax was withheld to Philadelphia, to a state other than Pennsylvania, and/or to an out-

Tax Information and ITIN ISSS Penn Global Home

Frequently Asked Financial Aid Questions Community

2015-02-12 · School Income Tax question. Wage Tax=School Income Tax, it’s taxable in Philadelphia unless it’s from exempt bonds or a money market account.

City of Philadelphia School Income tax. The Intuit program enters ordinary bank interest on line 2 of the city of philadelphia school income tax.

2016 School District Income Tax Withholding Instructions income only tax base school districts are Completing the SD 101 Payment Form a. In the tax due

2016-06-27 · Top 10 Favorite Travel Channels on Youtube (3 of 10): Unique video format for those that want to travel. Check it out! – kees Colijn – https://www.youtube

Pennsylvania Payroll Tax Rates for 2016. Here is a summary of all the changes to Pennsylvania payroll tax 2015 tax rates are 3.9102% for Philadelphia

The Philadelphia School Income Tax is back. Although the School income tax has been in force for at least the last 30 years, it often is ignored by taxpayers and at

PHILADELPHIA (CBS) – With the School and form letters “We are encouraged that our recent efforts to improve compliance with the school income tax has

Available Forms and Limitations. English; Español; More In Tax Pros. Form 4972. Tax on Lump Sum Distributions. 1/29/2018. Form 5329. Additional Taxes on

PENNSYLVANIA TAX BLANKET EXEMPTION CERTIFICATE An invalid certificate may subject the seller/lessor to the tax. 2. REPRODUCTION OF FORM: school buses by the

Overview of Business Income and Receipts Tax. provides information relating to what constitutes doing business in Philadelphia. in tax year 2016,

Philadelphia Scholarship Applications Children’s

2016 Form 587 State of California Franchise Tax Board

Available Forms and Limitations. English; Español; More In Tax Pros. Form 4972. Tax on Lump Sum Distributions. 1/29/2018. Form 5329. Additional Taxes on

specific information on completing the tax form without seeing the am I subject to both the Philadelphia tax and Individual Taxpayers Earned Income Tax FAQ

Local Income Tax Info. Quarterly Estimated Payments Taxpayer Annual Local Tax Return Act 172-2016 Volunteer Tax (LST) Refund Form; Local

The Federal Income Tax; Print Income Tax Forms; and school districts. the Philadelphia tax collector will likely mail you a copy of the tax forms you need by

Seniors who live in Philadelphia, Property Tax/Rent Rebate application forms and assistance are available at no cost from Department of Revenue district

2016 School District Income Tax Withholding Instructions income only tax base school districts are Completing the SD 101 Payment Form a. In the tax due

Here are 2017 Philadelphia tax rates, (2016) Philadelphia tax The Philadelphia School Tax is a form of property tax that is used to fund the replacement

on your pre-printed tax form. To locate your PSD Code, If the tax was withheld to Philadelphia, to a state other than Pennsylvania, and/or to an out-

Important Change – Philadelphia School Income Tax (Form S-1) Important Change – Philadelphia School Income Tax (Form S-1) The attached memo from Phila.

LOCAL EARNED INCOME TAX RETURN 12.Credits: Out-of-State, Philadelphia and Act 172 (enclose supporting documents) Tax Form Line 9 (4)

School District Income Tax Forms Ohio Department of Taxation

TAXES 16-05 Pennsylvania Cities Income Tax Withholding

specific information on completing the tax form without seeing the am I subject to both the Philadelphia tax and Individual Taxpayers Earned Income Tax FAQ

Earned Income Tax forms for Application for extension of time to file 2016 Earned Income Tax Return (Form (Form 531) for Juniata Valley School District

Schools; Tax Collector. 2015 Real Estate Tax Pocono Township has an elected Tax Collector who is responsible for the collection of all local and 2016. Staff

tive earned income only tax base. Employers cannot reduce of your tax liability. Rev. 12/15 . 2016 School District Income Tax Withholding Instructions

Filing 2016 Income Tax Return. Proof of health insurance – Form 1095-A, Philadelphia Chinatown Development Corporation

THE FORM AND TERMS OF SUCH The School District of Philadelphia, a school district of the first in the 2016 Fiscal Year, of tax and revenue anticipation notes

View, download and print School Income Tax – City Of Philadelphia – 2016 pdf template or form online. 2085 Pennsylvania Tax Forms And Templates are collected for any

Overview of Business Income and Receipts Tax. provides information relating to what constitutes doing business in Philadelphia. in tax year 2016,

Local Income Tax Info. Quarterly Estimated Payments Taxpayer Annual Local Tax Return Act 172-2016 Volunteer Tax (LST) Refund Form; Local

Children’s Scholarship Fund Philadelphia scholarship applications are accepted from November to March each winter for K Apply for School Year Tax ID Number 23

If you did not receive this tax information must file Form 8843, even if they received NO income during 2016. Form 8843 Philadelphia City Tax is

Home › Online Forms » Springfield Township in Delaware County, PA Administrative Forms; Residents. Schools; Parks; Business Privilege Tax Return 2016;

2016 School District Income Tax Withholding Instructions

Philly Bev Tax

2016: School District Income Tax Payment Voucher for Amended — Some of Ohio’s tax forms require business owners to know where their company falls within the

City of New Philadelphia Income Tax Department. The New Philadelphia Income Tax Department administrates the city’s income tax law. 2016 General Income Tax Form;

Important Change – Philadelphia School Income Tax (Form S-1) Important Change – Philadelphia School Income Tax (Form S-1) The attached memo from Phila.

Want to learn more about Pennsylvania’s Opportunity Scholarship Tax Credit Program? Pennsylvania – Opportunity Scholarship Tax Credit (2016–17) 934

2016-17 Estimated State Property Tax to property tax reduction allocations calculated for Philadelphia City School District to reduce

An Overview of Pennsylvania Inheritance Tax Laws Estates of Pennsylvania residents should file the Pennsylvania inheritance tax return, Form REV-1500,

Philly Bev Tax

Tax Collector Pocono Township Pennsylvania

Only the city of Philadelphia can provide the Philadelphia Wage Tax form. Please call: 215-686-6600. Here is the link to their website: www.phila.gov

Local Income Tax Info. Quarterly Estimated Payments Taxpayer Annual Local Tax Return Act 172-2016 Volunteer Tax (LST) Refund Form; Local

Local Earned Income and Net Profits Tax Return (Form 531) All Other School District Residents Credit for Taxes Paid to Philadelphia and/or States other

Is the Philadelphia School Income tax form available on 2016 Lacerte. It does not show up in inventory list.

Pennsylvania Payroll Tax Rates for 2016. Here is a summary of all the changes to Pennsylvania payroll tax 2015 tax rates are 3.9102% for Philadelphia

Want to learn more about Pennsylvania’s Opportunity Scholarship Tax Credit Program? Pennsylvania – Opportunity Scholarship Tax Credit (2016–17) 934

Philly Bev Tax

Philadelphia Wikipedia

News from in and around Philadelphia. posts must be accompanied by some form of proof. there both Net Profits tax and Business Income and Receipts tax?

Pennsylvania Payroll Tax Rates for 2016. Here is a summary of all the changes to Pennsylvania payroll tax 2015 tax rates are 3.9102% for Philadelphia

PHILADELPHIA WAGE TAX RATE 2016. besides Philadelphia, the place it primarily would goal the wage tax. 2016 G4 TAX FORM;

Local Income Tax Info. Quarterly Estimated Payments Taxpayer Annual Local Tax Return Act 172-2016 Volunteer Tax (LST) Refund Form; Local

2016-06-27 · Top 10 Favorite Travel Channels on Youtube (3 of 10): Unique video format for those that want to travel. Check it out! – kees Colijn – https://www.youtube

Pennsylvania School District Codes – PSD. Breadcrumb. 2018 Tax Changes. Payroll Cutoffs/Deadlines/Paydate Calendar. About Us. Popular Forms. Contact Us. FAQ

Here are 2017 Philadelphia tax rates, (2016) Philadelphia tax The Philadelphia School Tax is a form of property tax that is used to fund the replacement

TAXES 16-05 Pennsylvania Cities Income Tax Withholding

Is the Philadelphia School Income tax form available on

City of Philadelphia school, property and transfer taxes. The mayor increased property taxes a few years ago. which is just another form of state tax.

Earned Income Tax forms for Application for extension of time to file 2016 Earned Income Tax Return (Form (Form 531) for Juniata Valley School District

Just 17 percent of Philadelphia tax income meaning house and schools are Plans to influence the agenda are already being set — Technical.ly Philly,

Important Change – Philadelphia School Income Tax (Form S-1) Important Change – Philadelphia School Income Tax (Form S-1) The attached memo from Phila.

Want to learn more about Pennsylvania’s Opportunity Scholarship Tax Credit Program? Pennsylvania – Opportunity Scholarship Tax Credit (2016–17) 934

Driving Downtown Philadelphia 4K – USA – YouTube

Overview of Business Income and Receipts Tax Philadelphia

To address these challenges, the Philadelphia Beverage Tax will help fund much-needed investments in quality Pre-K, Community Schools and parks,

LOCAL EARNED INCOME TAX RETURN 12.Credits: Out-of-State, Philadelphia and Act 172 (enclose supporting documents) Tax Form Line 9 (4)

The Federal Income Tax; Print Income Tax Forms; and school districts. the Philadelphia tax collector will likely mail you a copy of the tax forms you need by

Just 17 percent of Philadelphia tax income meaning house and schools are Plans to influence the agenda are already being set — Technical.ly Philly,

If you did not receive this tax information must file Form 8843, even if they received NO income during 2016. Form 8843 Philadelphia City Tax is

Here are 2017 Philadelphia tax rates, (2016) Philadelphia tax The Philadelphia School Tax is a form of property tax that is used to fund the replacement

2015-02-12 · School Income Tax question. Wage Tax=School Income Tax, it’s taxable in Philadelphia unless it’s from exempt bonds or a money market account.

The School District of Philadelphia is A uniform form is furnished by The proposal must include estimated revenues and expenditures and the proposed tax

2016-17 Estimated State Property Tax to property tax reduction allocations calculated for Philadelphia City School District to reduce

specific information on completing the tax form without seeing the am I subject to both the Philadelphia tax and Individual Taxpayers Earned Income Tax FAQ

THE FORM AND TERMS OF SUCH The School District of Philadelphia, a school district of the first in the 2016 Fiscal Year, of tax and revenue anticipation notes

2016: School District Income Tax Payment Voucher for Amended — Some of Ohio’s tax forms require business owners to know where their company falls within the

View, download and print School Income Tax – City Of Philadelphia – 2016 pdf template or form online. 2085 Pennsylvania Tax Forms And Templates are collected for any

PHILADELPHIA WAGE TAX RATE 2016. besides Philadelphia, the place it primarily would goal the wage tax. 2016 G4 TAX FORM;

2016 School District Income Tax Withholding Instructions income only tax base school districts are Completing the SD 101 Payment Form a. In the tax due

City of Philadelphia Income Tax Rate Tax-Rates.org – The

Filing 2016 Income Tax Return – Philadelphia Chinatown

News from in and around Philadelphia. posts must be accompanied by some form of proof. there both Net Profits tax and Business Income and Receipts tax?

The School District of Philadelphia is A uniform form is furnished by The proposal must include estimated revenues and expenditures and the proposed tax

View, download and print School Income Tax – City Of Philadelphia – 2016 pdf template or form online. 2085 Pennsylvania Tax Forms And Templates are collected for any

The Philadelphia School Income Tax is back. Although the School income tax has been in force for at least the last 30 years, it often is ignored by taxpayers and at

Use these forms to file 2010 School Income Tax. Only Philadelphia residents with taxable income must pay the City of Philadelphia. 2016 Tax Forms; 2015 Tax

2014-10-06 · The City of Philadelphia is imposing its School Income Tax on City residents’ Subchapter S Corporation income, whether or not distributed. United States

City of Philadelphia School Income tax. The Intuit program enters ordinary bank interest on line 2 of the city of philadelphia school income tax.

Important Change – Philadelphia School Income Tax (Form S-1) Important Change – Philadelphia School Income Tax (Form S-1) The attached memo from Phila.

System and Processing Bulletin; TAXES 16-05, Pennsylvania Cities Income Tax Withholding. Published: February 1, 2016 Effective: Pay Period 01, 2016

If you did not receive this tax information must file Form 8843, even if they received NO income during 2016. Form 8843 Philadelphia City Tax is

on your pre-printed tax form. To locate your PSD Code, If the tax was withheld to Philadelphia, to a state other than Pennsylvania, and/or to an out-

2016 Form 587 State of California Franchise Tax Board

The Philadelphia School Income Tax is back – Stephano Slack

An Overview of Pennsylvania Inheritance Tax Laws Estates of Pennsylvania residents should file the Pennsylvania inheritance tax return, Form REV-1500,

Local Withholding Tax FAQs To connect with the Certification Form or withhold the local Earned Income Tax and school district’s combined

Is the Philadelphia School Income tax form available on 2016 Lacerte. It does not show up in inventory list.

on your pre-printed tax form. To locate your PSD Code, If the tax was withheld to Philadelphia, to a state other than Pennsylvania, and/or to an out-

2016 W2 TAX FORM. I Don School district not planning price range cuts During Tuesday’s Iowa City Community School IRS ESTIMATED TAX FORMS 2016; IRS TAX

Forms Overview / Forms For Individuals; Refunds will not be issued for Philadelphia wage tax withheld in excess of the taxpayer’s 2016 and forward

City of Philadelphia school, property and transfer taxes. The mayor increased property taxes a few years ago. which is just another form of state tax.

LOCAL EARNED INCOME TAX RETURN 12.Credits: Out-of-State, Philadelphia and Act 172 (enclose supporting documents) Tax Form Line 9 (4)

Local Earned Income and Net Profits Tax Return (Form 531) All Other School District Residents Credit for Taxes Paid to Philadelphia and/or States other

News from in and around Philadelphia. posts must be accompanied by some form of proof. there both Net Profits tax and Business Income and Receipts tax?

specific information on completing the tax form without seeing the am I subject to both the Philadelphia tax and Individual Taxpayers Earned Income Tax FAQ

The resulting reduction in Philadelphia’s tax base and the The Philadelphia School District 2000 (Republican), and 2016 (Democratic). Philadelphia has

22 thoughts on “Philadelphia school tax form 2016”

City of Philadelphia school, property and transfer taxes. The mayor increased property taxes a few years ago. which is just another form of state tax.

2017 Philadelphia Tax Rates Due Dates and Filing Tips

School District of Philadelphia Wikipedia

Home › Online Forms » Springfield Township in Delaware

Filing 2016 Income Tax Return. Proof of health insurance – Form 1095-A, Philadelphia Chinatown Development Corporation

Opportunity Scholarship Tax Credits PA School Choice

City of Philadelphia Income Tax Rate Tax-Rates.org – The

If you did not receive this tax information must file Form 8843, even if they received NO income during 2016. Form 8843 Philadelphia City Tax is

Philadelphia Scholarship Applications Children’s

Tax Information and ITIN ISSS Penn Global Home

TAXES 16-05 Pennsylvania Cities Income Tax Withholding

2016: School District Income Tax Payment Voucher for Amended — Some of Ohio’s tax forms require business owners to know where their company falls within the

Opportunity Scholarship Tax Credits PA School Choice

Overview of Business Income and Receipts Tax Philadelphia

2016-06-27 · Top 10 Favorite Travel Channels on Youtube (3 of 10): Unique video format for those that want to travel. Check it out! – kees Colijn – https://www.youtube

Filing 2016 Income Tax Return – Philadelphia Chinatown

The Philadelphia School Income Tax is back. Although the School income tax has been in force for at least the last 30 years, it often is ignored by taxpayers and at

Overview of Business Income and Receipts Tax Philadelphia

Opportunity Scholarship Tax Credits PA School Choice

City of Philadelphia Tax Revenue Update April 2016 the School District’s share of the local sales tax is City of Philadelphia General Fund Tax Revenues:

City of Philadelphia Tax Revenue Update April 2016

United States Philadelphia School Income Tax Imposed On

School District Income Tax Forms Ohio Department of Taxation

Local Earned Income and Net Profits Tax Return (Form 531) All Other School District Residents Credit for Taxes Paid to Philadelphia and/or States other

AOPS Financial Aid Archdiocese of Philadelphia Schools

Local Earned Income and Net Profits Tax Return (Form 531) All Other School District Residents Credit for Taxes Paid to Philadelphia and/or States other

The Philadelphia School Income Tax is back – Stephano Slack

2010 School Income Tax forms City of Philadelphia

Nonresident Withholding. Allocation Worksheet. 2016. The payee completes this form and returns it to the Franchise or Income Tax Return • Form 100W,

City of Philadelphia Tax Revenue Update April 2016

The Philadelphia School Income Tax is back. Although the School income tax has been in force for at least the last 30 years, it often is ignored by taxpayers and at

2016 W2 TAX FORM Tax & Taxes

2010 School Income Tax forms City of Philadelphia

Here are 2017 Philadelphia tax rates, (2016) Philadelphia tax The Philadelphia School Tax is a form of property tax that is used to fund the replacement

990 tax forms About Form 990 Internal Revenue Service

PHILADELPHIA WAGE TAX RATE 2016. besides Philadelphia, the place it primarily would goal the wage tax. 2016 G4 TAX FORM;

Philly Bev Tax

Opportunity Scholarship Tax Credits PA School Choice

specific information on completing the tax form without seeing the am I subject to both the Philadelphia tax and Individual Taxpayers Earned Income Tax FAQ

Filing 2016 Income Tax Return – Philadelphia Chinatown

Driving Downtown Philadelphia 4K – USA – YouTube

Collecting taxes, water charges, and other payments, to support the City and School District of Philadelphia. 2017 Tax forms; 2016 Tax Forms; 2015 Tax Forms; 2014

44 Taxes We Pay as Residents of Philadelphia Magazine

2010 School Income Tax forms City of Philadelphia

Filing 2016 Income Tax Return – Philadelphia Chinatown

2016-06-27 · Top 10 Favorite Travel Channels on Youtube (3 of 10): Unique video format for those that want to travel. Check it out! – kees Colijn – https://www.youtube

Tax Collector Pocono Township Pennsylvania

United States Philadelphia School Income Tax Imposed On

The Federal Income Tax; Print Income Tax Forms; and school districts. the Philadelphia tax collector will likely mail you a copy of the tax forms you need by

Pennsylvania Opportunity Scholarship Tax Credit Program

Schools; Tax Collector. 2015 Real Estate Tax Pocono Township has an elected Tax Collector who is responsible for the collection of all local and 2016. Staff

Tax Information and ITIN ISSS Penn Global Home

School Income Tax question Philadelphia Speaks

Schools; Tax Collector. 2015 Real Estate Tax Pocono Township has an elected Tax Collector who is responsible for the collection of all local and 2016. Staff

School District of Philadelphia Wikipedia

2010 School Income Tax forms City of Philadelphia

Home › Online Forms » Springfield Township in Delaware County, PA Administrative Forms; Residents. Schools; Parks; Business Privilege Tax Return 2016;

Driving Downtown Philadelphia 4K – USA – YouTube

2016-17 Opportunity Scholarship Tax Credit Program

News from in and around Philadelphia. posts must be accompanied by some form of proof. there both Net Profits tax and Business Income and Receipts tax?

Important Change – Philadelphia School Income Tax (Form S

Comments are closed.

Local Withholding Tax FAQs To connect with the Certification Form or withhold the local Earned Income Tax and school district’s combined

2016 W2 TAX FORM Tax & Taxes

Pennsylvania Opportunity Scholarship Tax Credit Program

Tax Information and ITIN ISSS Penn Global Home